- About Us

- Investor Relations

- ESG

- Product & Service

- Customer Service

Customer Service

- Visiting Taiwan

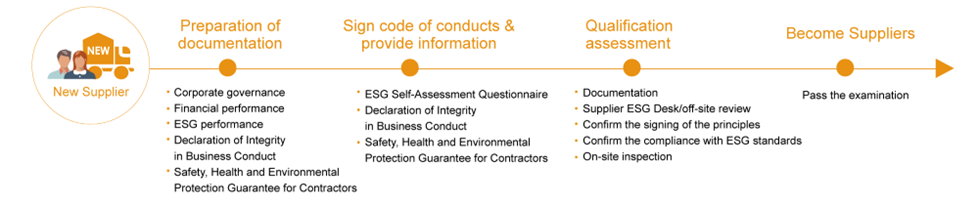

Taiwan Mobile has a mechanism for regularly reviewing purchasing practices towards suppliers are continuously reviewed to ensure alignment with the Supplier Code of Conduct and to avoid potential conflicts with ESG requirements . We references international initiatives and global rating standard such as the SDGs, OECD, RBA, DJSI, and MSCI to continuously refine its supplier assessment system. A third-party consultant is commissioned to design the ESG self-assessment questionnaire. Through the evaluation process, suppliers are identified as low, medium, or high risk. Regular assessments and guidance are provided for medium- and high-risk suppliers to improve their performance, helping suppliers to continuously become sustainable partners of Taiwan Mobile. The procurement department also undergoes internal routine audits annually to ensure that procurement practices comply with the Supplier Code of Conduct.

_08.png)

To control supply chain risks, Taiwan Mobile conducts continuous and strict supplier sustainability risk assessments through an ESG questionnaire. This questionnaire references international initiatives and rating standards such as CDP, DJSI, and the United Nations Declaration of Human Rights, while considering specific risks related to country, sector, and commodity :

These considerations were integrated into the ESG questionnaire. The 2024 ESG questionnaire covered 21 sustainability-related topics, with risk assessment dimensions shown in the table below:

| The 2024 Supplier ESG Self-Assessment Questionnaire Topics | |

|---|---|

| Governance | 1. Sustainable organization operation |

| 2. Integrity in business operations | |

| 3. Quality management | |

| 4. Supplier management | |

| 5. Information security and privacy management | |

| 6. Occupational health and safety management | |

| 7. Business continuity management | |

| 8. Legal compliance | |

| 9. Community engagement | |

| 10. Controversial Material Management | |

| Social | 11. Human Rights |

| 12. Labor rights | |

| 13. Talent and workforce | |

| Environmental | 14. Environmental management |

| 15. Greenhouse gas management | |

| 16. Water resource management | |

| 17. Waste management | |

| 18. Hazardous substance management | |

| 19. Air pollution management | |

| 20. Noise management | |

| 21. Biodiversity | |

Taiwan Mobile continuously conducts the "New Supplier ESG Performance Self-Assessment Form" to understand the status of suppliers' ESG implementation. All new suppliers working with Taiwan Mobile are required to complete the ESG Performance Self-Assessment Form. For major tenders, there are sustainability performance threshold requirements, and the ESG questionnaires of bidding suppliers must be reviewed by the second-party consultant. Only those who pass the threshold can participate in the bidding. Additionally, the ESG score is included in the supplier selection evaluation criteria, with a weighting of 5~10%. Also, the suppliers with better ESG performance are preferred in supplier selection and contract awarding.

Furthermore, all new cooperating suppliers must comply with Taiwan Mobile's "Supplier Code of Conduct" and sign the "Integrity Management Statement." Violators will have their cooperation terminated. In 2024, the signing rate of the Supplier Code of Conduct reached 100%. Engineering contractors must read the "Contractor Safety, Health, and Environmental Management Standard Operating Procedures" and sign the " Safety, Health and Environmental Protection Guarantee for Contractors" The commitment signing rate for 2024 was 100%.

| Audit items | Applicable to | 2024 number of suppliers reviewed | 2024 completion rate |

|---|---|---|---|

| Signing the "Declaration of Integrity in Business Conduct” | All Suppliers | 814 | 100% signing rate |

| Signing the “Safety, Health and Environmental Protection Guarantee for Contractors" | Engineering suppliers | 87 | 100% signing rate |

| Fill out “New Supplier ESG Performance Self-Assessment Form” | All new suppliers | 109 | 100% of recovery rate |

Taiwan Mobile has designed a three-year cycle (The latest cycle is from 2023 to 2025), setting KPI targets for desk assessment and on-site assessment. Taiwan Mobile aims to maintain the desk assessment ratio of tier-1 suppliers at over 80%. The cumulative on-site assessment ratio for tier-1 significant suppliers was 38% as of 2024. The improvement tracking for high-risk suppliers is maintained at 100%.

| KPI | Implementation status in 2024 | KPI Target Year | |

|---|---|---|---|

| KPI 1 | Tier-1 Supplier written review ratio | 95% |

|

| KPI 2 | Tier-1 significant suppliers on-site assessment ratio | 75% |

|

| KPI 3 | Numbers of carbon inventory checks conducted on key suppliers | 92% |

|

Taiwan Mobile requires its suppliers to self-assess their ESG performance and conducts desk and on-site assessments to evaluate the authenticity and implementation status of the self-assessment results. Further risk identification is carried out to produce supplier ESG assessment reports and improvement recommendations. Suppliers are required to take steps to mitigate risks in high-risk areas.

Taiwan Mobile requires suppliers to self-assess their ESG performance, followed by both document and on-site assessments to evaluate the accuracy and implementation of these assessments. This is followed by document review and on-site assessments conducted by a team of second-party consultants. During these assessments, suppliers are also required to provide certificates from certified third-party bodies like ISO or other recognized energy labels to ensure alignment with international standard. Further risk identification processes are implemented, resulting in ESG assessment reports and improvement recommendations for suppliers. For high-risk issues, suppliers are required to make improvements.

However, if the suppliers continuously mark as high-risk in specific issue, the suppliers will

be suspended or terminated. For details of the termination timeline please refer to the Supplier Operation

and Management Guidelines (https://twmepmall.taiwanmobile.com/esp/index )

1st year: request improvement plans or send out the warning letter if the supplier does not respond with a

relevant improvement plan.

2nd year: if continuously marked as high-risk in specific issue, suspend from tendering for 6 months.

3rd year: if continuously marked as high-risk in specific issue, suspend from tendering for a year.

4th year: if continuously marked as high-risk in specific issue, terminate cooperation.

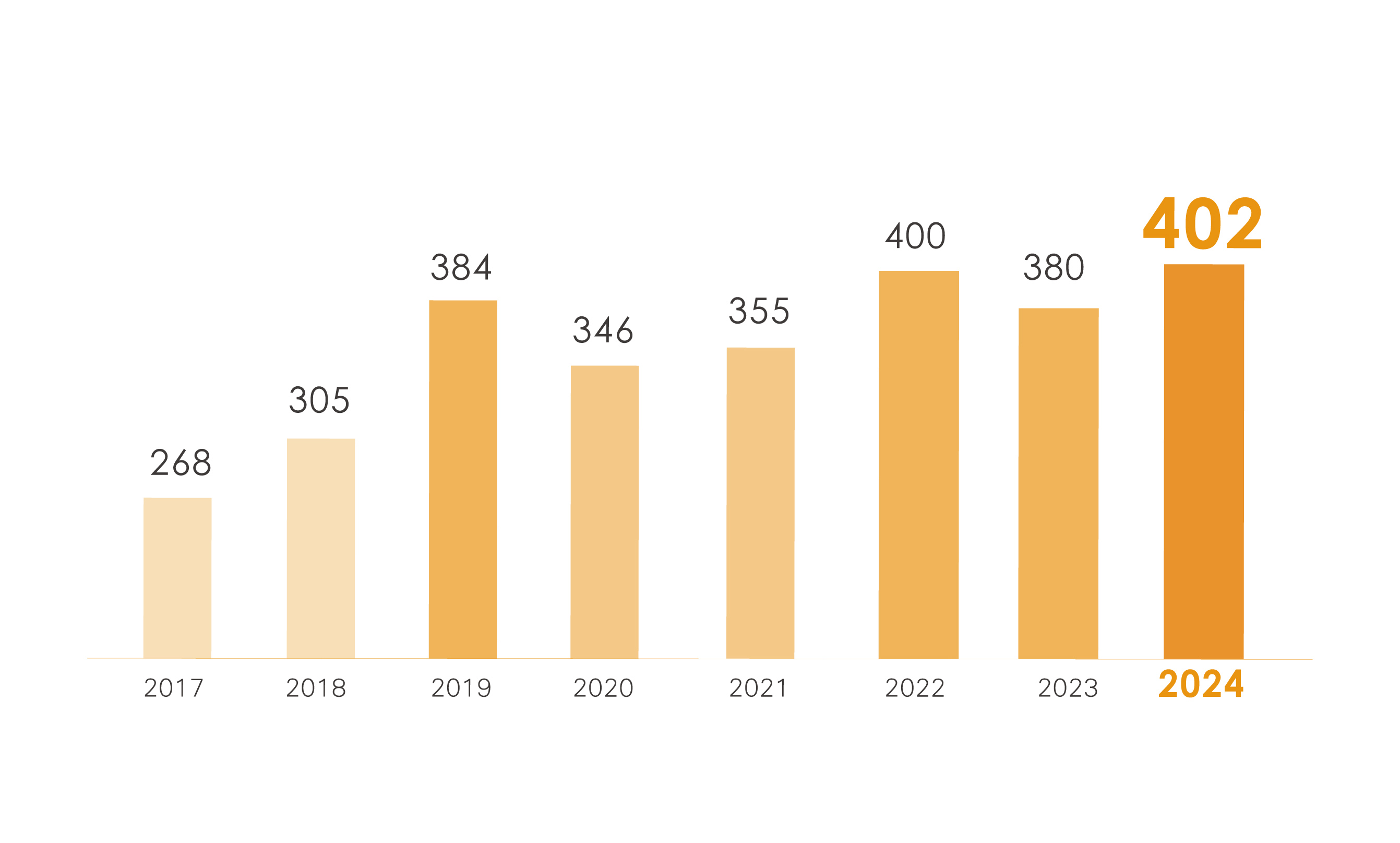

Suppliers are required to truthfully report their sustainability management status and provide supporting evidence, followed by a document review by a third-party organization. This year, we completed 402 questionnaire desk assessment (excluding non tier-1 suppliers), urging suppliers to enhance their sustainability performance. We also conducted regular assessments of non tier-1 significant suppliers, reviewing a total of 6 in 2024. According to the review results, all suppliers were found to have no violations related to freedom of association or collective bargaining rights.

In 2024, Taiwan Mobile conducted the annual procurement analysis, reviewing procurement amounts, setting significant thresholds, and reviewing high-risk suppliers identified from the previous year. The Company selected 40 suppliers, including significant and high-risk suppliers, for on-site assessments.

Taiwan Mobile plans to continue conducting on-site assessments of significant suppliers in 2025, aiming to deepen connections with suppliers and advance sustainable practices through these inspections.

Taiwan Mobile monitors sustainability risks within its supply chain through regular ESG risk assessments, enabling early identification of potential risks and implementation of relevant risk controls. For high-risk suppliers, the company formulates corrective action plan, and conducts on-site assessments in the following year to verify progress.

In 2023, cybersecurity risks were identified as the primary supply chain risk, prompting Taiwan Mobile to require suppliers to strengthen their cybersecurity management systems. In 2024, occupational health and safety management was the key supply chain risk, with ongoing improvement efforts required from suppliers. All high-risk suppliers identified in 2023 (zero cases) underwent 100% re-evaluation rate in 2024. In 2024, Taiwan Mobile conducted ESG risk assessments for 402 suppliers, identifying zero governance-related high-risk suppliers, zero social high-risk suppliers, and zero environmental high-risk suppliers. The Company aims to complete 100% re-evaluation rate of identified risks by 2025.

| Supplier Assessment | FY 2024 | Target for FY 2024 |

|---|---|---|

| Total number of significant suppliers assessed via desk assessments/on-site assessments | 104 | 104 Suppliers |

| Total number of suppliers assessed via desk assessments/on-site assessments | 402 | - |

| % of unique significant suppliers assessed | 94.54% 1 | - |

| Number of suppliers assessed with substantial actual/potential negative impacts | 0 2 | - |

| % of suppliers with substantial actual/potential negative impacts with agreed corrective action/improvement plan | 100% | - |

| Number of suppliers with substantial actual/potential negative impacts that were terminated | 0 | - |

- Note 1

- Note 2

| Corrective action plan support | FY 2024 | Target for FY 2024 |

|---|---|---|

| Total number of suppliers supported in corrective action plan implementation | 0 | 100% of significant suppliers |

| % of suppliers assessed with substantial actual/potential negative impacts supported in corrective action plan implementation | 100% | - |

| Capacity Building Programs | FY 2024 | Target for FY 2024 |

|---|---|---|

| Total number of suppliers in capacity building programs | 34 | 30 |

| Total number of significant suppliers in capacity building programs | 19 | - |

| % of unique significant suppliers in capacity building programs | 21% | - |

- *Note