- About Us

- Investor Relations

- ESG

- Product & Service

- Customer Service

Customer Service

- Visiting Taiwan

Taiwan Mobile’s independent director must meet all 12 criteria below:

- Criterion 1

- Not an employee of the Company or its affiliates.

- Criterion 2

- Not a director or supervisor of the Company’s affiliates (unless the person is an independent director of the Company, the Company’s parent company or any subsidiary of the Company).

- Criterion 3

- Not a shareholder whose total holdings, including those of his/her spouse and minor children, or shares held under others’ names, reach or exceed 1 percent of the total outstanding shares of the Company or rank among the top 10 individual shareholders.

- Criterion 4

- Not a spouse, relative within the second degree of kinship, or lineal relative within the third degree of kinship, of a manager under subparagraph 1 or any of the persons in the preceding two subparagraphs.

- Criterion 5

- Neither a director, supervisor, or employee of an entity that directly and/or indirectly holds more than 5% of the Company’s shares, nor one of the Company’s top five shareholders, or director, supervisor or employee of a corporate shareholder who appoints a representative as a director or supervisor of the Company in accordance with Article 27, paragraph 1 or 2 of the Company Act.

- Criterion 6

- Not a director, supervisor, or employee of a company of which the majority of board seats or voting shares is controlled by a person that also controls the same of the company.

- Criterion 7

- Not a director, supervisor, or employee of a company or institution of which the chairman, president (or equivalent) himself/herself or his/her spouse also serves as the company's chairman, president (or equivalent).

- Criterion 8

- Not a director, supervisor, manager, or shareholder owning more than 5% of the outstanding shares of any company that has financial or business relations with the Company.

- Criterion 9

- Not a professional, owner, partner, director or supervisor, or officer of a sole proprietorship, partnership, company, or institution that provides auditing services to the company or any affiliate of the company, or that provides commercial, legal, financial, accounting or related services to the company or any affiliate of the company for which the provider in the past two years has received cumulative compensation exceeding NT$500,000, or a spouse thereof; provided, this restriction does not apply to a member of the remuneration committee, public tender offer review committee, or special committee for merger/consolidation and acquisition, who exercises powers pursuant to the Act or to the Business Mergers and Acquisitions Act or related laws or regulations.

- Criterion 10

- Not a spouse or relative within second degree by affinity to other directors.

- Criterion 11

- Not in contravention of Article 30 of the Company Act.

- Criterion 12

- Not an institutional shareholder or its representative pursuant to Article 27 of the Company Act.

Our target share of independent directors on the board is at least 40%, which is much higher than the Securities Exchange Act’s requirement of no less than three1 in number and no less than one-fifth of the total number of directors.

| Title | Name* |

|---|---|

| Chairman | Daniel M. Tsai |

| Director | Richard M. Tsai |

| Independent Director | Char-Dir Chung |

| Independent Director | Hsi-Peng Lu |

| Independent Director | Tong Hai Tan |

| Independent Director | Drina Yue |

| Independent Director | Casey K.C. Lai |

| Director | Frank Lin |

| Director | Jamie Lin |

| Over five years of experience in business, finance, legal and/or other areas related to the Company's business |

Independence criteria (Notes) | Board Mandates | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | No. of public companies in which he or she also serves as an independent director |

No. of TWSE/TPEx listed companies in which he or she also serves as a non-executive/ independent directors |

|

| 0 | 2 | |||||||||||||

| 0 | 1 | |||||||||||||

| 1 | 1 | |||||||||||||

| 2 | 2 | |||||||||||||

| 0 | 0 | |||||||||||||

| 0 | 0 | |||||||||||||

| 1 | 1 | |||||||||||||

| 0 | 1 | |||||||||||||

| 0 | 3 | |||||||||||||

denotes executive director, the others are non-exe.

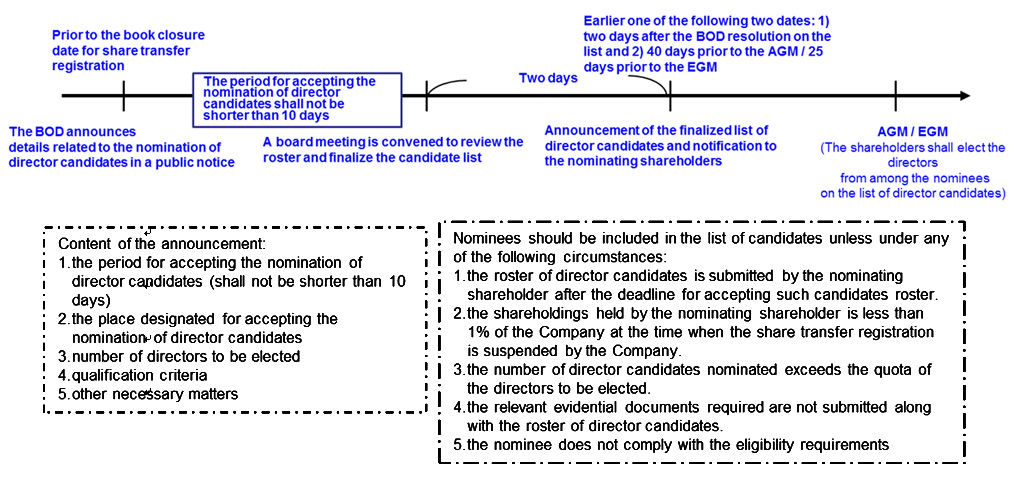

The election of directors is based on the candidate nomination system which is regulated in Article 192-1 of Company Act and the Company’s Articles of Incorporation. The shareholders shall elect the directors from among the nominees listed on the roster of director candidates.